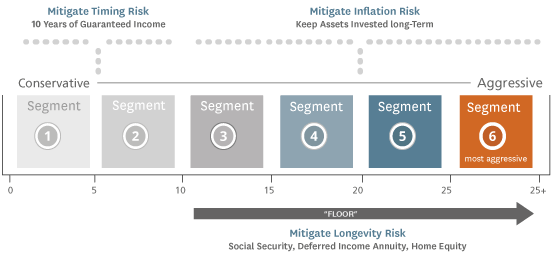

According to Kiplinger, “The biggest threat to retirement wealth is withdrawing too much money from a shrinking nest egg, because there may not be enough left to benefit from the inevitable market rebound.” That statement is correct, and it argues for “time-segmenting” your retirement savings. Time-segmentation makes it easier to align your retirement timeline with your investment strategy. It may also help you mitigate Timing Risk and Inflation Risk. By supplementing Social Security with a deferred income annuity, you can also better protect against Longevity Risk- the possibility of outliving your income.

The Income for Life Model® Strategy for the Constrained Investor®.

The emphasis is on helping you manage key risks.

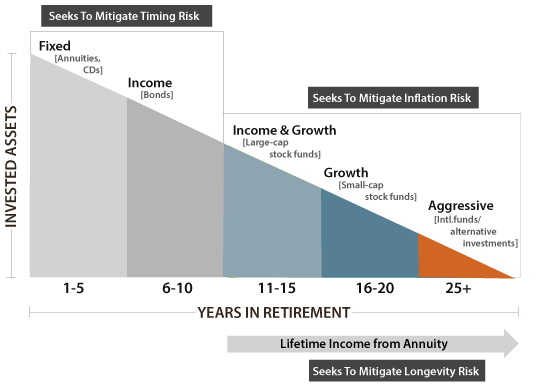

In one popular approach your deposit is shown as being allocated to six "segments" that will hold investment assets ranging from very conservative to aggressive. Segment One, the most conservative, receives the largest portion of your deposit - 28%. Successive segments receive, 26%, 20%, 13% 7% and 6% (total 100%). The segments receiving the smallest amount of money are those which hold progressively more aggressive assets. The more aggressive an investment, the more risk it is subject to. These segments will be held for the longest period of time in order to achieve the best possible chance of excellent investing results.

The Personalized Analysis

The Personalized Analysis describes your custom plan for creating monthly retirement income. It shows how your savings can be divided into multiple segments, each one earmarked to produce monthly income during various phases of your retirement: years 1-5, 6-10, 11-15, 16-20 and 21-25. The goal is to increase your income as you age.

Your plan will include a “Floor,” made up of those income sources which are stable and predictable- Social Security, pensions and income from annuities- and an “Upside,” that portion of your savings which is exposed to investment risk.

Constrained Investors are well-served with an income plan that blends both safe and risky investments.

In this way some of your money is exposed to market based growth potential, but your monthly income is always predictable because it is produced by an investment which is not exposed to market risk. That’s the key to a disciplined plan that you can keep consistent with throughout retirement and through all economic conditions.