[NEXForms id=”1″]

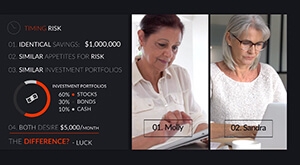

01. Timing Risk

Would you want to leave your retirement security to chance?

The reality is, that simply being unlucky in the timing of your retirement - just picking a year to retire that’s a bad one for stocks - can be the difference between your income continuing for years and years, or running out early. Don’t leave your retirement security to good luck or bad.

The Story of Molly and Sandra

Molly and Sandra are the same age, have the same amount of savings and are taking the same monthly income. How is it that Sandra loses $416,000 compared to Molly in only 4 years? Watch the movie! Don’t leave your retirement security to good luck, or bad.

02. Inflation Risk

The effect of rising prices can threaten a retiree’s standard of living. For example, in 1980, the average price of a new car was $7,210. By 1989, it had increased to $15,400. And in 2017, the average new car cost $33,560. At a 3% rate of inflation, a retiree loses 25% of his or her purchasing power every ten years.

Your strategy for creating retirement income must seek to keep your income on pace with inflation.

03. Longevity Risk

No retiree stops needing money. So a good question to contemplate is, “How long could my retirement last?” Think about the oldest person you know? Is he or she over 80? or 90? The fact is, a married couple age 65 has a 25% chance that the surviving spouse will live to age 98!

Your strategy for creating retirement income should provide a “floor" of monthly income you can’t outlive.

Be More Confident About Your Retirement.

No retiree stops needing income. And no retiree can know in advance which financial risks may threaten their standard-of-living.

Don’t confront retirement without a plan for monthly income. The Income for Life Model® helps you manage The 3 Big Risks™.